144,000,000 AST

2,100,000,000 AST

AST

144,000,000 AST

2,100,000,000 AST

AST

We Accept :

Web favorites

- Best Casinos Not On Gamstop

- Casinos Not On Gamstop

- Casino Not On Gamstop

- Gambling Sites Not On Gamstop

- Migliori Casino Online Italia

- Betting Sites Not On Gamstop UK

- Non Gamstop Casino Sites UK

- Non Gamstop Casino UK

- Non Gamstop Casino Sites UK

- Casino En Ligne

- Casino Sites Not On Gamstop

- Non Gamstop Casinos

- Non Gamstop Casinos

- Non Gamstop Casino UK

- UK Casino Not On Gamstop

- Best UK Casino Sites

- Non Gamstop Casino Sites UK

- UK Online Casinos Not On Gamstop

- Non Gamstop Casino Sites UK

- Casino Not On Gamstop

- Gambling Sites Not On Gamstop

- Slots Not On Gamstop

- Migliori App Casino Online

- Betting Sites Not On Gamstop

- Casinos Not On Gamstop

- Casinos Not On Gamstop

- Meilleur Casino En Ligne

- Meilleur Casino En Ligne

- Casino En Ligne

- Meilleur Site Casino En Ligne Belgique

- Poker Online Migliori Siti

- Avis Plinko

- ライブ カジノ

- Meilleur Casino Sans Verification

- Casino Nouveau En Ligne

- Casino En Ligne 2026

- Casino Non Aams

- Siti Scommesse Non Aams

- Nuovi Casino Italia

- Casino En Ligne France Fiable

Strategic Partners

CreditOK

Credit OK is a Thai fintech startup with the mission to unlock working capitals for micro-entrepreneurs & enterprises in South East Asia. With around 400 million micro-entrepreneurs & enterprises in Southeast Asia & with the rise of alternative data, we want to leverage it to help assess them to get working capital financing and improve their cash flow & business through deep credit scoring with alternative data & lending platform.

Rewarding

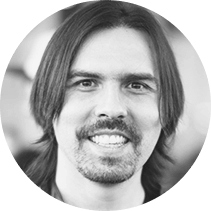

Without intermediaries, the AssetStream Platform offers at least 0.75% upto 4% monthly yield from your investment

Diversified

The AssetStream platform assembles SMEs from different industries, meaning that you can diversify your investment and risk. Diversifying your investment portfolio with cryptocurrencies can offer high-growth potential and hedge against traditional market volatility. Emerging digital assets provide unique opportunities for early adopters. Participating in the $SUBBD token presale 2025 allows investors to access innovative utility-driven crypto at early-stage pricing, potentially maximizing returns in the evolving digital economy.

Reliable

A Self Regulated community with verified profiles and blockchain technology, greatly reduces the risks correlated with non profit loans

Regular

Lenders receive their return on investment on a monthly basis and can convert it immediately to their origin cryptocurrency. As the cryptocurrency market continues to evolve, investors are constantly searching for the next cryptocurrency to explode in terms of growth and potential. Identifying the next big cryptocurrency can be challenging, as the market is highly volatile and unpredictable.

Less is more

Directly offer your suggeted interest rate to the community without any intermediaries

Flexible

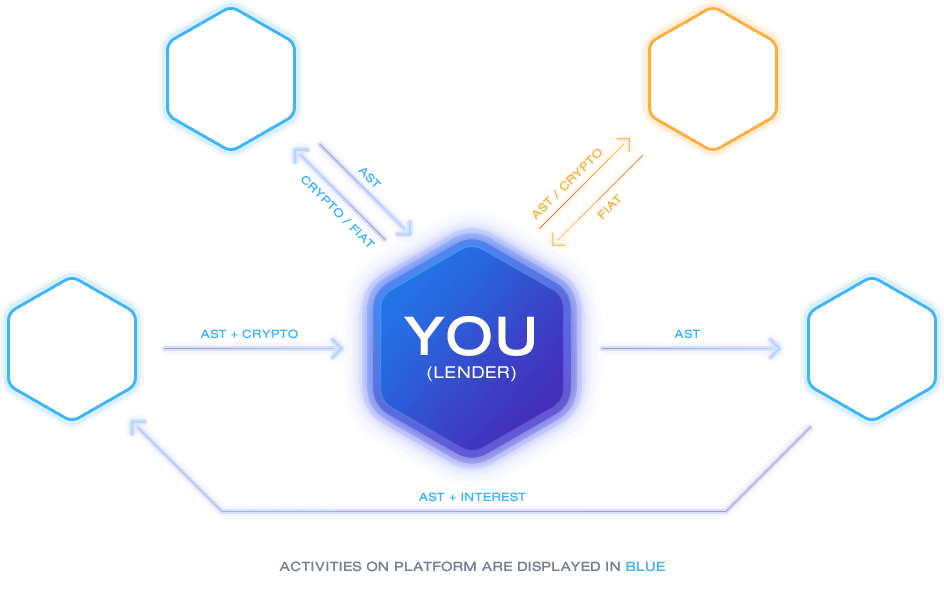

Create contracts, choose the intrest rate, conditions and duration as a borrower

Quick

The AssetStream Platform automatically matches small loan requests with Lenders who set up the small loan lender preferences. The result is almost instant loan approval. The automatic matching feature is currently still under development and will be added in the future

Effortless

The loan application process is much lighter, compared to that of most financial institutions, yet it is secure enough to prevent the community from harm

Empowerment

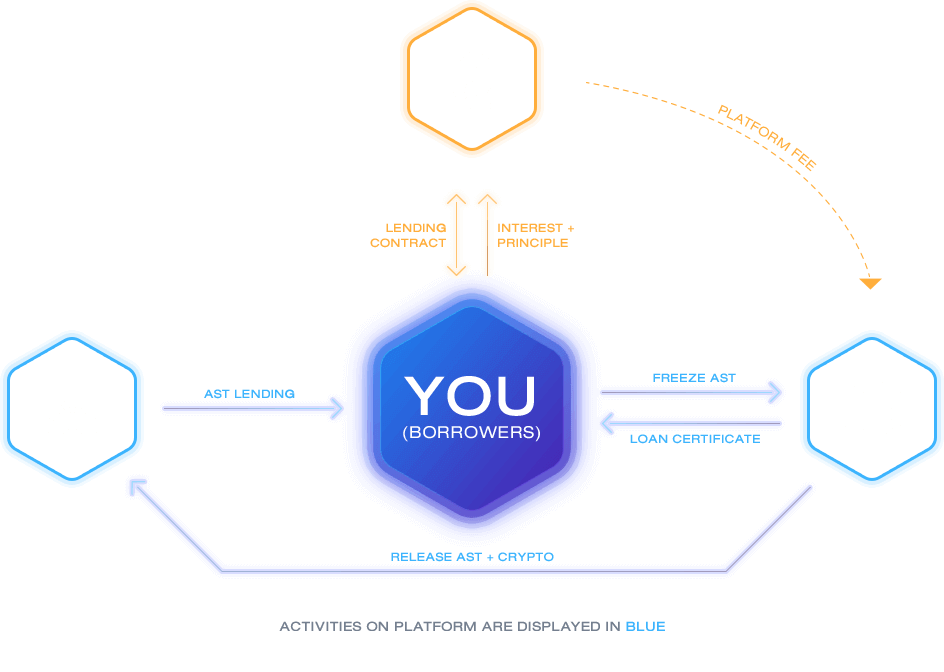

Making profit with the AssetStream platform is simple. For every project you accept AssetStream will reward you for your service with a cut of the interest

Entrepreneurship

All borrowers on the platform have gone through a credit rating and KYC process before they are allowed to utilize the platform, creating a verified community. Incase of NPL AssetStream will compensate you with the collateral of that loan

Self development

With a platform full of borrowers at your display you will be able to reach out to more borrowers and increase your returns

Financial literacy

Incase a borrower does not fulfill its duty and legal action is required. AssetStream will provide 360° support for the Local Agency during the legal process

-

Renaud Laplanche

CEO and founder of Lending ClubThe idea is that the part of the rate cut will be absorbed by lower defaults.

-

Henri Arslanian

Fintech Aficionado, Chairman of FinTech Association of Hong KongBankers of the future and those who will shape the prospect of this industry, are not going to be your traditional bankers but rather designers, programmers and creative thinkers.

-

Alex Mashinsky

CEO & Founder of Celsius NetworkBlockchain disrupts traditional borders and regulatory barriers and replaces them with systems that do what is in the best interest of its members.

-

Bill Sinclair

CEO of SALT LendingWe’ve always had an impression that one day we'd be able to lend anywhere on earth.

-

Spiros Margaris

Fintech ExpertFintech Industry has a potential to have its largest positive impact on the lives of the unbanked of this world. And That's, In my eyes, is the magic in process.

-

Cesar A. Hidalgo

Associate Professor and leads the Collective Learning group at MITTechnologies that change society are technologies that change interactions between people.

Founder, Head of IT & Development

Co-Founder, Head of Strategy & Marketing

Co-Founder, Head of Communication

Co-Founder, Managing Partner

Senior Application Development Manager

Senior Project Manager

Business Development Manager

BONUS TOKENS

-

TOTAL TOKENS

180M ASTMay 27 - 31Presale

-

TOTAL TOKENS

240M ASTJun 1 - 51st Round

-

TOTAL TOKENS

240M ASTJun 6 - 102nd Round

-

TOTAL TOKENS

240M ASTJun 11 - 153rd Round

-

TOTAL TOKENS

240M ASTJun 16 - 204th Round

-

TOTAL TOKENS

240M ASTJun 21 - 255th Round

-

TOTAL TOKENS

240M ASTJun 26 - 306th Round

-

TOTAL TOKENS

240M ASTJul 1 - 57th Round

-

TOTAL TOKENS

240M ASTJul 6 - Until Hard Cap Reached8th Round

Token Distribution

Token Distribution Token Sale

Bounty

Management & Advisory

Product & Business Development

Marketing & PR

2.1 Billion

144 Million

Accepted purchase methods

100% Guarantee Withdrawable

Commission Free

Fast and Accuracy

High Security

-

Four co-founders founded the AssetStream project as a great potential solution for the low-income communities in developing countries who are struggling with the loan shark problem.

-

After fundamental researches a proof of concept had been created.

-

The proof of concept reached legal and technical viability.

-

During this period the AssetStream project evolved from a potential side project to a fully self-funded project, geared towards launching in 2019.

-

The recruitment team recruits professionals and specialist from Belgium, South Korea, Thailand, Singapore, Philippines and many more location around the world.

-

Start development process of the AssetStream platform prototype.

-

Selected Thailand as flagship region due to compliance of law, norm, customer behavior, market size.

-

Reached the demonstration version of platform infused with blockchain technology.

-

Approached potential partners with demonstration version of the platform.

-

Reached an agreement with the first strategic partners, Thailand PICO Finance Association (Consists with 1000+ money lending company).

-

Approached the public as the AssetStream Platform aiming towards offering an alternative finance solution to customers in developing countries.

-

Attended Hong Kong Fintech week 2018.

-

Attended as one of the premium exhibitors at Consensus 2018 Singapore.

-

Attended as one of speakers during ‘BlockChain Innovation Tour’ promoting the AssetStream platform in Malaysia, Philippines, Vietnam, Thailand, Singapore.

-

AssetStream Platform with its strategic partners (Finanigo, Pico Finance Association Thailand) held the press conference event in target market.

-

Determined the Launching date of the AssetStream Platform and AssetStream Token (AST) Token Distribution.

-

Start online advertising and public relation campaigns.

-

Launch AssetStream social channels including Youtube, Facebook Fanpage, Twitter, Instagram, Telegram Group, Wechat, Line Official.

-

Start development of AssetStream platform mobile version.

-

Contributing Money/BlockChain expos around the world to meet the potential investors and platform users in person.

-

May - AssetStream Token (AST) Token Distribution takes place.

-

June - The AssetStream Platform is fully operational.

-

July - AssetStream’s first monthly pay out to Lenders.

-

Listing AssetStream Token(AST) on external 3rd party Exchange.

-

Contribute Money/BlockChain expos around the globe to meet the potential investors and platform users in person.

-

Announce the 2nd and 3rd target market (Potentially Vietnam, Philippines) with its strategic partners.

-

AssetStream Platform with its strategic partners hold a press conference event in both target market.

-

Contribute Money/BlockChain expos around the globe to meet the potential investors and platform users in person.

-

October - New volume of AssetStream Token (AST) Token Distribution takes place.

-

November - Platform functions for 2nd and 3rd target are fully operational.

-

December - 2nd and 3rd target market first monthly payout to its lenders.

-

Contribute Money/BlockChain expos around the globe to meet the potential investors and platform users in person.

-

AssetStream Platform beta test the features of peer to peer lending and start launching from the best situation of the target market.

-

AssetStream becomes a full functioning versatile global lending platform together with the regional strategic partners.

-

Start online advertising and public relation campaigns.

-

Launching of AssetStream platform on mobile to the available market.

-

Together with its local strategic partners, Assetstream expands its territory of service.

-

The AssetStream platform can expand itself entering credit scoring, banking business base on user data of the platform.

-

Pursue the social mission as social enterprise to apply basic financial education to developing countries to help prevent people from making financial mistakes and reduce reliability on loan sharks which improves the overall living quality.

-

AssetStream @

Blockchain Innovation Tour : Singapore

-

AssetStream @

Blockchain Innovation Tour : Vietnam

-

AssetStream @

Blockchain Innovation Tour : Thailand

-

AssetStream @

Blockchain Innovation Tour : Philippines

-

AssetStream @

Blockchain Innovation Tour : Malaysia

-

AssetStream @

Consensus 2018 Singapore

Soft Cap

Soft Cap

Google Chrome browser.

Google Chrome browser.